What is Lithium

Lithium, also known as “white gold,” is a powdery white, lightweight non-ferrous metal that is a crucial component in a vast majority of rechargeable lithium-ion batteries. This substance is combined with nickel and cobalt to create a rechargeable battery pack and is used in most personal electronics, such as laptops, cell phones, and EVs (Electric vehicles). Electric vehicles being affected by this shortage can also change a great deal of how EVs will be manufactured and utilized across the world. However, many lithium supplies have been strained due to high global demand over the past year.

Currently, lithium is produced from brine mines or hard rock, with Australia being one of the world’s largest areas of hard rock mines, while Argentina, Chile, and China, produce mainly from their salt lakes.

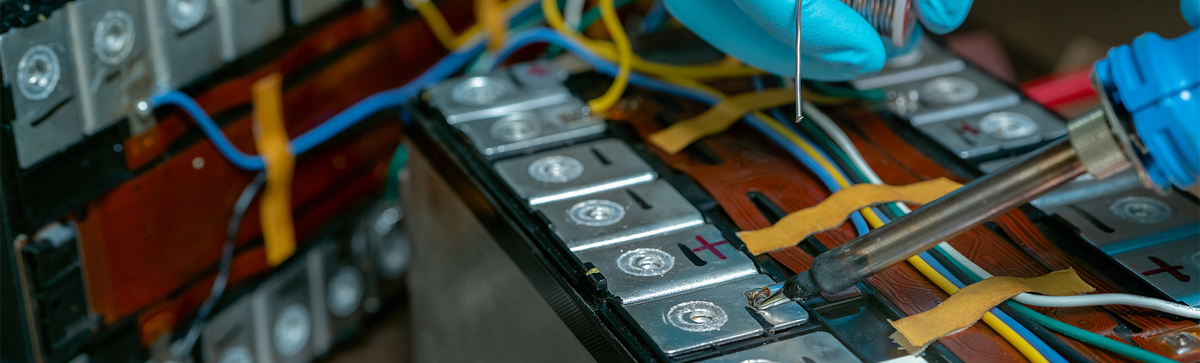

What is needed to produce an EV battery?

According to figures from the US Department of Energy science and engineering research center Argonne National Laboratory, a lithium-ion battery pack for a single electric car contains about 8 kilograms (kg) of lithium. The US Geological Survey further states that global lithium production totaled 100,000 tons (90.7 million kilograms) last year, while worldwide reserves stand at about 22 million tons (20 billion kilograms). Taking the lithium production divided by the amount needed per battery shows that last year mined just under 11.4 EV batteries. International Energy Agency (IEA) figures estimate that after first-quarter sales rose by 75% in the year, hitting 2 million, this could become the annual electrical vehicle purchases.

When producing an EV battery, it is crucial to understand where lithium comes from and how it’s measured. Lithium is measured in tonnes, more commonly known as a metric ton. The total global production of lithium carbonate equivalent was forecasted by Australia’s Department of Industry in December at 485,000 tonnes in 2021, growing to 615,000 tonnes in 2022 and 821,000 tonnes in 2023. Credit Suisse, a global investment bank and financial services firm founded and based in Switzerland, forecasted 588,000 tonnes in 2022, and 736,000 tonnes in 2023, and demand outpacing supply growth, with about two-thirds of that for electric vehicle batteries. These figures are projected for all lithium mines worldwide.

What is the challenge (what’s needed to produce an EV and meet demands)?

One of the main challenges of the potential Lithium shortage is how to economically mine lithium sustainably. It will take efforts from each member of the supply chain to meet demands while protecting the environment, including mining companies, refineries, battery manufacturers, car manufacturers, automotive OEMs, and financers. Those involved in this supply chain should work closely with stakeholders, NGOs, and their governments to adhere to the benefits of nations and local communities while utilizing best environmental practices.

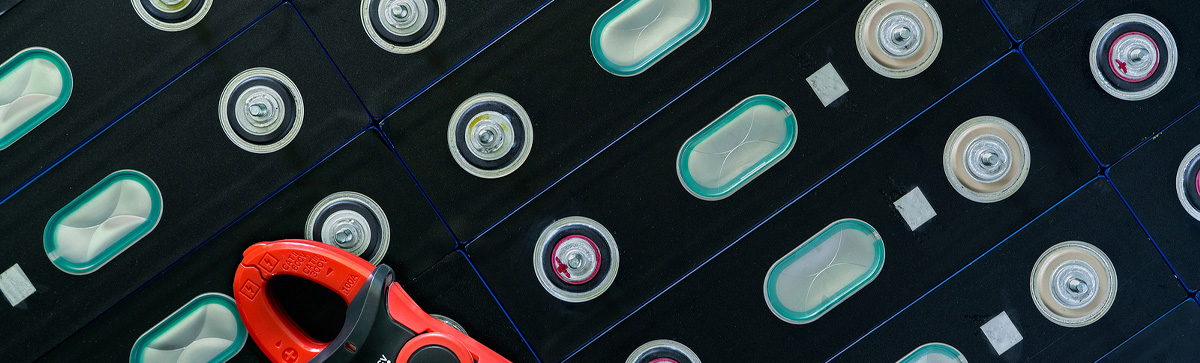

With the strain of supplies because of the high demand for EV production, there is an impending supply crunch waiting to happen if there is no coordinated action in the transition from fossil fuels to renewable energy. In the battle against climate change, according to the (IEA), EVs are currently making up 9% of the market from the jump of EV purchases from 3 million in 2020 to 6.6 million in 2021. In worldwide car sales, the IEA found that EV sales had risen from 63.8 million in 2020 to 66.7 million, meaning the sale of non-electric vehicles has fallen by 700,000. Due to the immediate need for producing electric vehicles’ lithium-ion batteries, there is a global metal shortage, making western countries scramble to find mines to compete with China.

What is causing the shortage?

While, in theory, the world’s lithium supply should meet the demands of EV production, they fail to account for a few things. The first flaw in this calculation assumes that all of the lithium mined will be utilized for electric vehicles only. This, however, is not the case. Much of the lithium mined goes into laptops, personal devices, batteries, and more. Another factor not accounted for is that not all lithium mined is pure enough to be used in production. The IEA states, “Only a handful of companies can produce high-quality, high-purity lithium chemical products.”

According to the IEA’s report on ‘The Role of Critical Minerals in Clean Energy Transitions,’ they estimate nearly 80% of mining projects were completed late, with many lithium mines beginning after 16.5 years of development in 2010 to 2019. Due to this, the IEA projects that the world will face lithium shortages by as soon as 2025. Reuters reports that “ there is only enough lithium to produce up to 14 million EVs in 2023, which could leave many would-be buyers empty-handed.” The amount of lithium needed to be extracted globally will fall short of demand. This is due to the amount of physical lithium and the mines’ capacities to refine the mineral into the chemical lithium-ion. Only a handful of mines can produce the substance reliably due to weather, natural disasters, pandemics, and geopolitical events.

With the impending shortage of lithium means the impending shortage of EV car batteries is not far behind and can begin to affect many business processes. Some of the larger-scale processes this EV shortage may hinder same day delivery services and trucking. This could affect how EVs are changing deliveries and what the future may hold.

Reliability of supply

As mentioned previously, many mines are only as reliable as their environments allow them to be. Some settings are natural causes, such as weather; some are human causes, such as geopolitical events; and some are environmental causes. The human causes are one of the reasons why lithium mining is considered to be controversial. The extraction of lithium requires very high volumes of water, which may pose a few environmental hazards, such as groundwater contamination. Current extraction technology and processes require a large amount of water, which can cause significant opposition in arid regions such as Serbia, Portugal, and even the US.

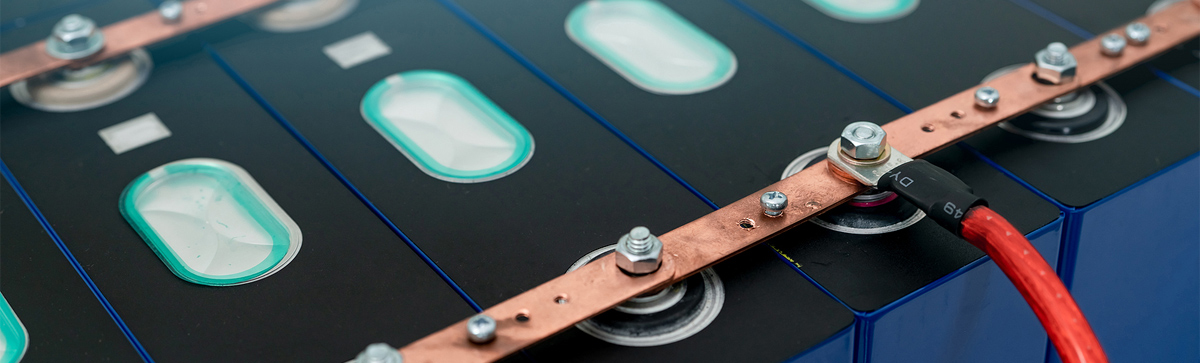

Though future discoveries of large lithium deposits are inevitable, they will change supply dynamics, and environmental dilemmas will still need to be addressed. However, the current concentration of lithium mines is only found in a few places, with one being located where the majority of the electric vehicle supply chain manufacturing occurs. China accounts for nearly 70-80% of the lithium-ion electric vehicle supply chain, and the IEA puts chinas shares at 60% of the global lithium production and 80% of the lithium hydroxide output.

Cost of lithium

The cost of lithium carbonate has skyrocketed over the past year by 432% due to the high demand of Chinese lithium-ion battery manufacturers. The compound’s cost 6 years ago was around $11,00 per metric ton and is now hitting $62,000. This price spike is primarily due to the EV market. The demand for lithium, put on battery manufacturers, has, in turn, applied pressure to the mineral suppliers. While the Earth has plenty of this natural resource, lithium bicarbonate must be extracted from its underground reserves and brine pools, incurring more financial and environmental costs. In addition, the growing need for lithium-ion batteries in the auto industry is so high many current mining operations cannot keep up with demand.

While this will not immediately affect the supply chain, the price of lithium has been, even though there is enough to meet current demand until approximately 2025 and 2030 if recycling options become available. Following this, lithium shortages will come, and even assuming all of the probable or possible lithium-mining projects are implemented with lithium recycling projects, by 2030, lithium production will still drop by 4% or 100,000 metric tons. With this projected shortage, the supply gap will acute to at least 24% or 1.1 million tonnes than demand.

Is there a way to solve this shortage?

Since electric vehicles are still relatively new to the automotive industry, the future development of Lithium-ion batteries or manufacturing methods may provide potential solutions to lithium shortages or ease the demand. The IEA says in The Role of Critical Minerals in Clean Energy Transitions, “Emerging technologies, such as direct lithium extraction or enhanced metal recovery from waste streams or low-grade ores, offer the potential for a step change in future supply volumes.” They also state that by 2030, EV batteries reaching the end of their lifespan are expected to increase significantly, and recycling these by 2040, could account for one-tenth of the supply requirements of lithium. In a similar report ‘A Vision for a Sustainable Battery Value Chain in 2030,’ The World Economic Forum states, “In the base case, an estimated 54% of end-of-life batteries are expected to be recycled in 2030,” and that in this year, 7% of the raw materials used in battery production could be covered.

Another alleviation of the lithium shortage is the emergence of a second-hand car market. Bloomberg reports that China is actively trying to develop this market and that their sales have doubled to 47,000 between 2017 and 2020 alone. In the UK, a similar trend is occurring where EV sales have also more than doubled to 14,586. Although these are not huge numbers, if electric vehicle sales remain on this trend, second-hand sales will also.

The last significant key factor in alleviating the shortage crisis is EV fleets. Many companies plan to switch and help in global efforts against climate change. Reliable couriers are one of those companies. We plan to make the switch and benefit our consumers and the world. Check out our blog post on ‘How EVs are changing deliveries and what the future holds to see how EVs can benefit you.